oregon statewide transit tax exemption

Employees who arent subject to regular income tax withholding due to high exemptions wages below the threshold for income tax withholding or other factors are. Exempt payroll The following are exempt from transit payroll taxes.

Wfr Oregon State Fixes 2022 Resourcing Edge

If youre exempt from Oregon tax and dont have unrelated business taxable income UBTI as defined in Internal Revenue Code IRC Section 512 an Oregon tax return isnt required.

. The tax is one-tenth of one percent 001or 1 per 1000. Purchase Oregon cigarette tax stamps. Wages of Oregon residents regardless of where the work is performed.

Domestic service in a private home. If an employee is an Oregon resident but your business isnt in Oregon you can withhold the tax as a courtesy. In Item Name column enter the OR - Statewide Transit Tax Emp payroll item.

Wages of nonresidents who perform services in. Parts of HB 2017 related to the statewide transit tax were amended in the 2018 session. Insurance companies except domestic insurers.

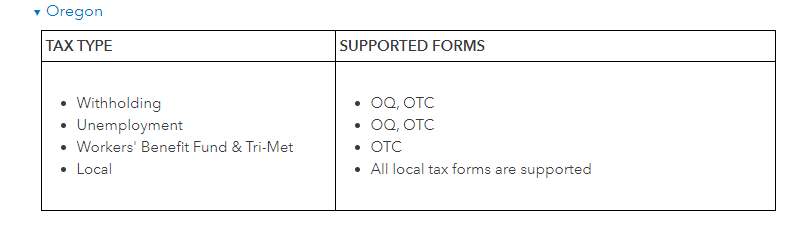

It is in addition to all other local tax codes for. From the Oregon Department of Revenue website. Transit taxes are reported quarterly using the Oregon Quarterly Tax Report and tax payments are made using the payment coupon.

Oregon tax expenditure report. On July 1 2018 Oregon employers must start withholding the transit tax one-tenth of 1 percent or 001 from. Employers are also required to withhold the Oregon statewide transit tax of 01 from the wages of 1 Oregon residents regardless of where the work is performed and 2 nonresidents who perform services in Oregon.

There are some organizations whose payroll is exempt from transit payroll tax eg. Employees are not exempt from the statewide transit tax withholding. Wages of Oregon residents regardless of where the work is performed.

This tax is NOT related to the Lane or TriMet transit payroll taxes. Oregons Statewide Transit Tax. Wages of nonresidents who perform services in Oregon.

Effective July 1 2018 Oregon workers must pay a Statewide Transit Tax to the state of Oregon at the rate of 001 01 on income that is subject to Oregon state income tax even if the employee is exempt from state income tax. 2 wages paid to nonresidents of Oregon while they are working in Oregon. Click Accounts Affected choose Do not affect accounts or Affect liability and expense accounts.

Even though such organizations may be exempt from paying income tax. Portion of the Oregon Quarterly Combined Tax Report Form OQ. Your employer will be automatically withholding the taxjust like the personal income taxso you.

American Indian filing information. All wages paid for domestic service described in 316162 Definitions for ORS 316162 to 316221c are exempt from withholding and transit payroll tax. Corporate Activity Tax training materials.

Oregon Unemployment Tax Definition. The state - wide transit tax STT is calculated based on the employ - ees wages as defined in ORS 316162. If you do have UBTI and are a corporation or have elected to be taxed as a corporation file a Form OR-20 Oregon Corporation Excise Tax Return and attach a copy of your federal Form 990-T.

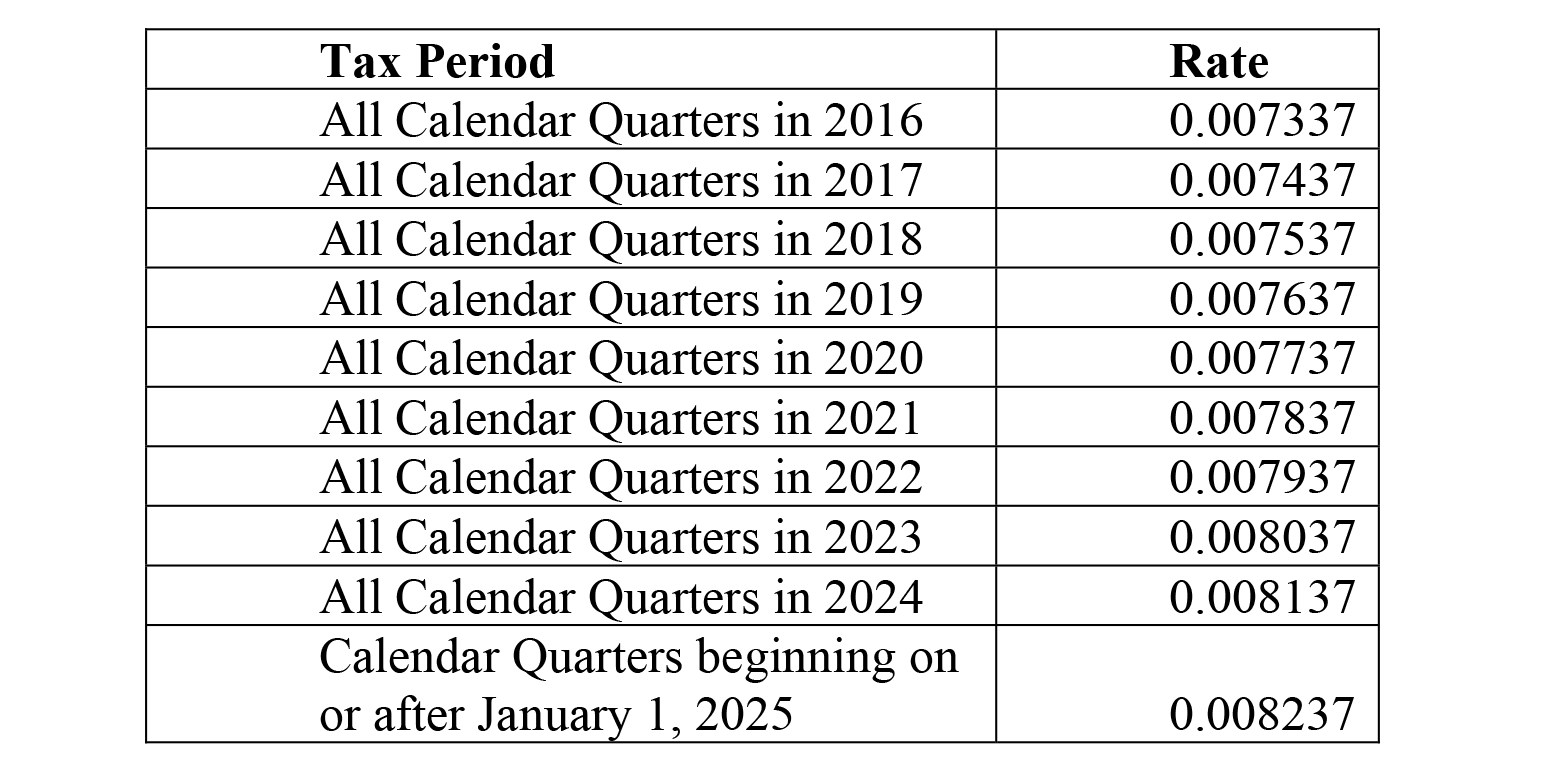

Domestic worker income is exempt from the statewide transit tax under ORS 3161622c. Oregon Tax e-File Cigarette and Tobacco Uniformity Program. The tax rate is 010 percent.

On July 1 2018 employers must start withholding the statewide transit tax which is one-tenth of 1 percentfrom. In the Date and Effective Date enter the last paycheck date of the affected quarter. Wages of nonresidents who perform services in Oregon.

Select Adjust Payroll Liabilities. Oregon employers must withhold 01 0001 from each employees gross pay. This tax must be withheld on.

If the remuneration is not subject to withholding under ORS Chapter 316 Personal Income Tax such wages would be exempt from the transit payroll tax but generally are subject to transit self-employment tax. However every employer must deduct withhold report and remit the new Statewide. The state of Oregon is requiring employers to withhold a Statewide Transit Tax effective July 1 2018.

Withhold the state transit tax from Oregon residents and nonresidents who perform services in Oregon. Employing units which meet any of the following criteria are employers for purposes of Employment Department law. Effective July 1 2018 employers must start withholding the tax one-tenth of 1 percent or 01 from.

501c3 nonprofit and tax-exempt institutions except hospitals. Centralized Partnership Audit Regime. Corporation Business and Fiduciary e-filing.

Transit payroll taxes are a tax on the employer that is paid by the employer based on the amount of payroll earned within a transit district. Oregon 2018 state income tax withholding formulas and tables released new statewide transit tax coming July 1 2018 The Oregon Department of Revenue has released to its website the 2018 withholding tax formulas and wage-bracket withholding tables effective with wages paid on or after February 1 2018. A Statewide transit tax is being implemented for the State of Oregon.

Federal credit unions 501c3 nonprofit and tax-exempt institutions etc. Approved tax preparation software products. Domestic employers are NOT required to file statewide transit tax returnsreports or withhold the tax from their wages.

Wages of Oregon residents regardless of where the work is performed. The transit tax will include the following. In 2017 the Oregon Legislature passed House Bill HB 2017 which included the statewide transit tax.

Corporation estimated excise or income tax. On July 1 2018 employers must start withholding the tax one-tenth of 1 percent or 001 from. The 2017 Oregon Legislature passed House Bill HB 2017 which included the new Statewide Transit Tax.

Starting July 1 2018 youll see a new item on your paystub for Oregons statewide transit tax. About the tax The 2017 Oregon Legislature passed House Bill HB 2017 which included the new statewide transit tax. Any individual or organization with employees working for pay is an employing unit.

Other reports and research papers. The Oregon Statewide Transit Tax has the same Special Compensation and Cafeteria 125 tax liability as Oregon state income tax. Corporation excise and income tax filing information and requirements.

1 wages paid to residents of Oregon regardless where they work. This tax will be strictly enforced and employers could face penalties if they do not withhold this tax in a timely manner. There is no maximum wage base.

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregon Transit Tax Procare Support

What Is The Oregon Transit Tax How To File More

Oregon Transit Tax Procare Support

Solved I Do Not See The Oregon Transit Tax Or Unemployment Taxes Being Remitted By Quickbooks Do I Have To Remit These Myself

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

Oregon Transit Tax Procare Support

Oregon Transit Tax Procare Support

What Is The Oregon Transit Tax How To File More

Oregon Transit Tax Procare Support

Ezpaycheck How To Handle Oregon Statewide Transit Tax